The upcoming budget dilemma: Can reductions in Medicaid funding finance tax cuts?

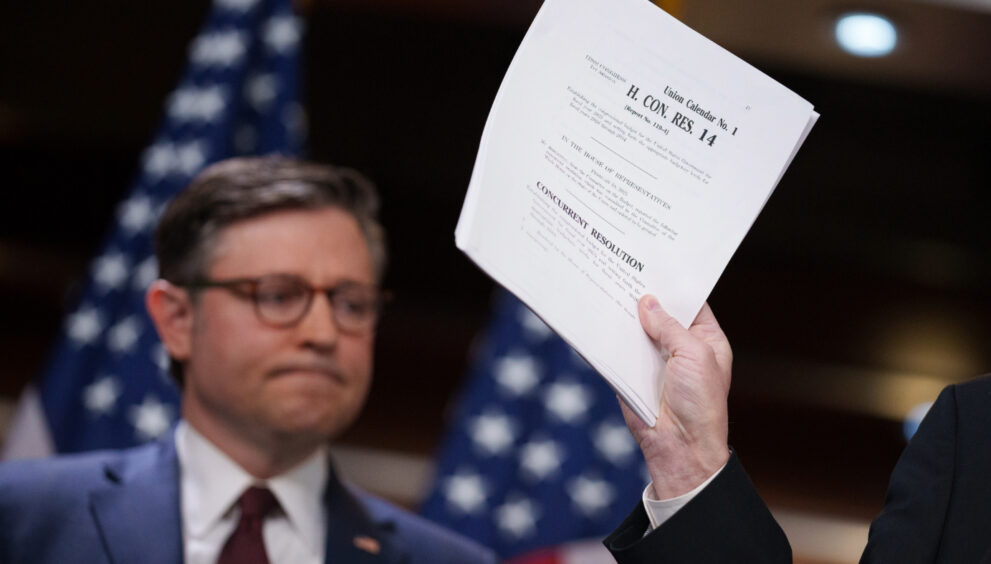

The necessity of upholding fiscal responsibility will become evident in the upcoming months after the recent approval of the House of Representatives budget resolution for the fiscal year 2025 on Feb. 25.

This resolution is laying the groundwork for potential legislation that could bypass the 60-vote threshold in the Senate and be approved with a simple majority. While it does not detail specific alterations to spending and taxes, it does specify the House committees responsible for funding deficits in reconciliation legislation and the extent of such funding.

In their reconciliation instructions for the fiscal year 2025 budget, the House proposes cuts in mandatory spending totaling $2 trillion over a decade. From this overall amount, $880 billion is earmarked to come from the Energy and Commerce Committee, which oversees Medicaid. This program is a joint federal and state health insurance initiative that covers 72 million low-income and disabled individuals. The benefits provided by Medicaid include nursing home care, personal care services, and assistance with premium payments and other expenses.

Republicans in Congress are prepared to address the issue of Medicaid because they feel the program has drifted significantly from its original intent of supporting the impoverished and disabled to assisting able-bodied, employed adults with lower incomes. Nonetheless, President Trump’s stance on cutting Medicaid is uncertain. House Speaker Michael Johnson (R-La.) has stated that any reductions in the program will be aimed at addressing “fraud, waste and abuse.”

Since the enactment of the Affordable Care Act in 2010 and following the onset of the COVID-19 pandemic in 2020, Medicaid expenditures have risen by more than 200 percent. The Affordable Care Act allowed states to expand Medicaid coverage to adults with incomes up to 138 percent of the poverty level.

During the COVID-19 pandemic, Medicaid’s expansion occurred due to individuals losing their jobs and employer-provided health insurance, rendering them eligible for Medicaid. The federal government introduced the Families First Coronavirus Response Act, which boosted federal Medicaid matching funding in return for states guaranteeing continuous coverage throughout the public health emergency.

House Republicans are presently reviewing the extent and type of Medicaid cuts being proposed. Some of the suggestions include reducing the federal match rates for new Medicaid enrollees, as well as instituting per capita limits for state programs seeking matching funds. Additionally, there’s a proposal for Medicaid beneficiaries to meet work requirements, although this is only expected to save approximately $100 million over a decade.

Contrary to claims in the press, Republicans assert that their aim is not to weaken but rather reform Medicaid. They emphasize that even with the proposed $880 billion reduction, Medicaid spending is forecast to rise substantially in the coming years.

With Medicaid and other mandatory programs consuming an increasing portion of federal outlays, many are of the opinion that Congress needs to establish boundaries. Mandatory programs and net interest expenses accounted for around 50 percent of federal expenditure fifty years ago; today, they make up nearly 75 percent, a figure that’s steadily rising.

Even if the targeted spending cuts are achieved, the federal debt is on track to grow by $2.8 trillion over a decade. This is mainly due to the anticipated decrease in tax revenues if key provisions of the Tax Cut and Jobs Act are extended beyond the present.